The financial services landscape is constantly evolving, influenced by a myriad of factors including economic shifts, technological advancements, and regulatory changes. Regulatory changes in financial services are pivotal as they aim to ensure the stability, transparency, and fairness of the financial system. These changes can significantly impact how financial institutions operate, affecting their compliance strategies, operational costs, and competitive positioning in the market.

Read Now : Interdisciplinary Research Quality Frameworks

Understanding Regulatory Changes

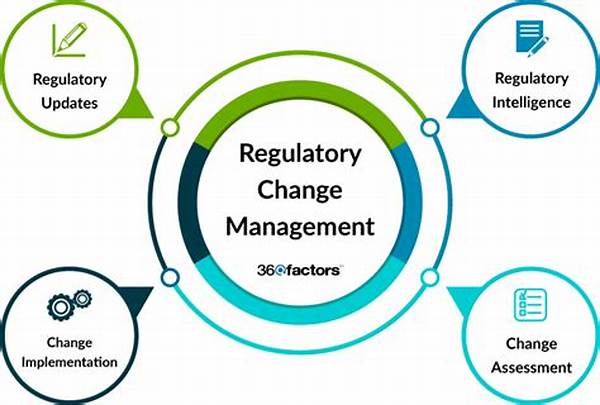

Regulatory changes in financial services are crucial as they safeguard the interests of consumers and maintain trust in the financial system. Financial regulators, such as central banks and securities commissions, implement these changes to mitigate risks, combat financial crimes, and promote market integrity. The ongoing development and adaptation of regulations serve as a proactive measure to address emerging threats like cybersecurity, fraud, and systemic risk. As the global financial system becomes increasingly interconnected, regulatory changes are not confined to local jurisdictions but often have international implications. Consequently, financial institutions must remain agile and responsive to changes not only in their home countries but across their areas of operation. Effective management of regulatory change requires robust compliance frameworks, continuous monitoring of regulatory updates, and a strategic approach to align business operations with regulatory expectations.

Key Aspects of Regulatory Changes

1. Consumer Protection: Regulatory changes in financial services enhance consumer protection, ensuring that customers are treated fairly and transparently.

2. Risk Management: Regulatory changes are designed to enhance the risk management frameworks within financial institutions, helping them to identify and mitigate potential threats.

3. Market Integrity: Maintaining market integrity is a focal point of regulatory changes, promoting transparent and fair financial markets.

4. Technological Adaptation: Emerging technologies like fintech necessitate regulatory updates to accommodate innovation while addressing potential risks.

5. Cross-Border Compliance: As financial markets globalize, regulatory changes often emphasize cross-border compliance and cooperation among international regulatory bodies.

Impacts of Regulatory Changes

The impacts of regulatory changes in financial services are multifaceted, influencing not only the structural aspects of financial institutions but also their strategic directions. For instance, the emergence of fintech technologies has compelled regulators to revise outdated regulations, ensuring that they accommodate digital transformations while safeguarding consumers and market stability. As these changes unfold, financial institutions may encounter increased compliance costs and must invest in advanced technological solutions to adhere to new standards. Nevertheless, these challenges are accompanied by opportunities, particularly for institutions that leverage regulatory compliance as a means to enhance their operational resilience and competitiveness. It’s crucial for financial institutions to cultivate a proactive culture that values compliance not just as a legal obligation, but as a strategic asset that fosters trust and innovation.

Navigating the Global Regulatory Landscape

1. Regulatory changes in financial services require a global perspective due to the interconnected nature of financial markets.

2. Adapting to international regulatory frameworks is essential for financial institutions operating across multiple jurisdictions.

3. Collaboration among regulators promotes a more harmonized approach to financial regulation.

4. Financial institutions must invest in regulatory intelligence to track global regulatory trends and requirements.

Read Now : Enhancing Productivity Through Automation Strategies

5. Understanding cultural and jurisdictional regulatory nuances improves a firm’s ability to comply with diverse frameworks.

6. Continuous education and training ensure that compliance teams are well-versed in evolving regulatory mandates.

7. Strategic partnerships may help firms navigate complex global regulatory environments.

8. Technology plays a crucial role in managing cross-border regulatory compliance efficiently and effectively.

9. Regulatory changes in financial services necessitate robust communication strategies to keep stakeholders informed.

10. Proactive engagement with regulators can facilitate smoother transitions to new regulatory standards.

Strategic Response to Regulatory Shifts

Adapting to regulatory changes in financial services requires a comprehensive strategic response. This response involves aligning organizational processes, technologies, and human resources with new regulatory requirements to ensure seamless compliance. Financial institutions need to establish dynamic compliance frameworks capable of responding swiftly to regulatory updates. Such frameworks are underpinned by technology solutions that facilitate real-time monitoring of regulatory changes, data analytics for risk assessment, and automated reporting systems to streamline compliance processes. Furthermore, fostering a culture of compliance across all levels of the organization is imperative. Employees must be trained consistently on regulatory expectations, and compliance should be integrated into performance metrics. It is also essential for institutions to engage in dialogue with regulators, industry peers, and external advisors to gain insights and share best practices. By adopting a collaborative and forward-thinking approach, financial institutions can effectively navigate regulatory challenges while capitalizing on new opportunities for growth and innovation.

Compliance Framework Innovations

Innovations in compliance frameworks emerge as a critical component of adapting to regulatory changes in financial services. As regulations become more complex, compliance frameworks have evolved to incorporate cutting-edge technologies, enabling institutions to manage compliance with greater efficiency and precision. Automated compliance tools, utilizing machine learning and artificial intelligence, are increasingly adopted to conduct comprehensive risk assessments, detect anomalies, and generate regulatory reports. These innovations significantly reduce manual intervention, lower the potential for human error, and enhance overall compliance accuracy. Additionally, blockchain technology is being explored to create immutable records of transactions, providing enhanced transparency and auditability. By using advanced technologies, financial institutions can transform compliance from a reactive function into a proactive strategy that aligns with business objectives, fosters resilience, and builds consumer trust.

Conclusion and Future Outlook

In conclusion, regulatory changes in financial services represent a dynamic and complex landscape that financial institutions must navigate strategically. These changes, driven by evolving global markets, technological advancements, and consumer needs, necessitate continuous adaptation and innovation. Financial institutions that effectively anticipate, understand, and respond to regulatory shifts are better positioned to maintain compliance, build competitive advantage, and drive long-term success. Looking to the future, the regulatory environment will likely become more intricate, especially as emerging technologies, such as cryptocurrencies and decentralized finance, pose new challenges and opportunities. Financial institutions must remain vigilant, investing in technology, talent, and collaborative partnerships to meet the ever-evolving regulatory demands, ensuring they remain at the forefront of a resilient and inclusive financial ecosystem.